GRUPO MEXICO IS A MEXICAN HOLDING COMPANY, THE LARGEST MINING CORPORATION IN MEXICO, THE LARGEST COPPER PRODUCER IN THE WORLD AND ITS RAIL TRANSPORTATION DIVISION, GRUPO FERROCARRIL MEXICANO (FERROMEX) OPERATES THE NATION’S LARGEST RAIL FLEET.

In this article we will examine what Grupo México’s end game might be in acquiring Florida East Coast Railway (FECR) from Fortress Investment Group LLC (FIG).

First, some background:

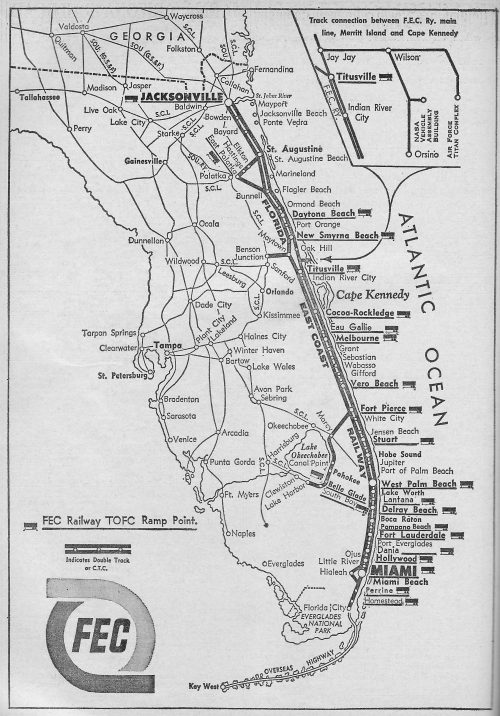

FECR was purchased in 2007 by equity funds managed by FIG. In announcing its its agreement to acquire FECR on for $ 2.1 billion on 3.28.2017, Grupo México’s statement said FECR “is a unique and irreplaceable asset with 565 miles of track that offers rail services along Florida’s east coast.”

Ferromex, Grupo México’s rail transportation division, runs Mexico’s largest and most profitable railway, with nearly 6,000 miles of tracks and 15,000 carloads, transporting over 40% of all the rail cargo of the country.

It has the largest coverage of the Mexico’s railway system. The rail system connects the main cities in the country, where 70% of industrial production is created and services five land ports on the border with USA, four seaports on the Pacific Ocean and two on the Gulf of Mexico.

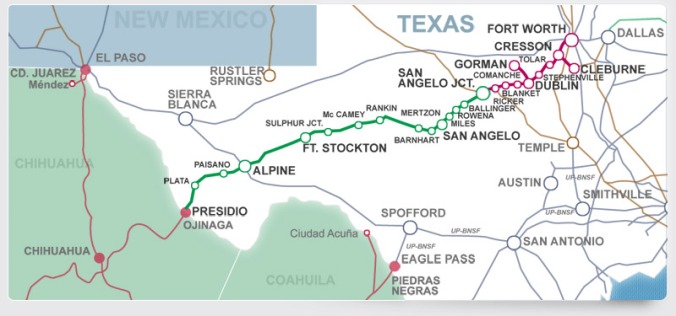

Grupo México owns Texas Pacifico Transportation Ltd. (TPT), a railroad operating company in West Texas. The company operates over the South Orient Rail Line, which runs from the Mexican border town of Presidio, Texas to San Angelo Junction.

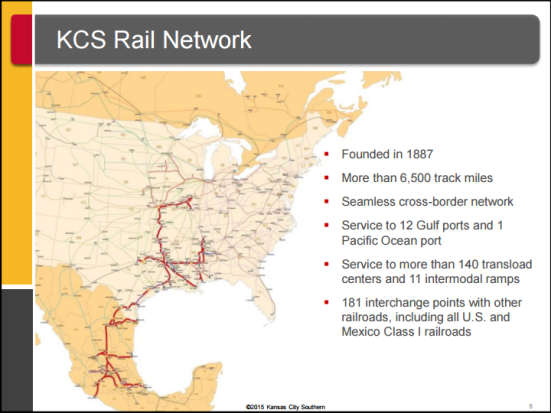

Then there is the Kansas City Southern Railway Company (KCS), owned by Kansas City Southern, the smallest and third-oldest Class I railroad in North America, just behind Union Pacific Railroad and Canadian Pacific Railway.

KCS owns and indirectly operates Kansas City Southern de México (KCSM) in the central and northeastern states of Mexico, and is the only Class I Railroad to own any track both inside and outside of Mexico’s boundaries.

KCS was founded in 1887 and is currently operating in a region consisting of ten central U.S. states.

(Ferromex is the only other Class I operating in Mexico).

Including all trackage owned by wholly owned subsidiaries, KCS owns a total of approximately 6,000 route miles of track.

Thus far we have established a network of Grupo México trains traveling from the U.S. in and out of Mexico.

Now let’s look at where they get their cargo.

Lázaro Cárdenas is home to a deep-water seaport that handles container, dry bulk, and liquid cargo.

The port currently has one container terminal, which handled 1.24 million TEU in 2012, and has a total capacity of 2.2 million TEU annually. TEU stands for Twenty-Foot Equivalent Unit which can be used to measure a ship’s cargo carrying capacity.

APM Terminals (APMT), an international container terminal operating company headquartered in The Hague, Netherlands operates the Lázaro Cárdenas deep-water seaport. It is is one of the world’s largest port and terminal operators.

APMT is building an additional container terminal that was/is expected to bring the port’s capacity to 3.4 million TEU in 2015 and 6.5 million TEU in 2020.

According to a report in World Maritime News on 2.28.17, Lázaro Cárdenas welcomed its first vessel, the 9,600 TEU Maersk Salalah.

With the first phase of the terminal complete, APM Terminals Lazaro Cardenas occupies an area of 49 hectares, with a quay of 750 meters in length for ships and a depth of 16.5 meters. (Source

“Today is a milestone as we add an additional operational terminal to our portfolio,” Morten H. Engelstoft, CEO of APM Terminals, said.

“We have a significant portfolio across Latin America, and this will be our second terminal in Mexico after Yucatan. We are pleased to be a contributor in helping Mexico to reach its growth ambitions,” Engelstoft added.

By the final phase of the terminal buildout, which is scheduled to happen between 2027 and 2030, the terminal’s water depth will increase to 18 meters.

By then, the terminal will have a quay 1.5 km long in a total area of 102 hectares and a capacity of 4.1 million TEUs, operated by 15 ship-to-shore (STS) cranes and 10 rail tracks, providing intermodal access.

The total investment cost for the full project is expected to reach some USD 900 million, according to APM Terminals.

Now let’s look at the container ships.

Since 1996, A.P. Møller – Maersk Group, based in Copenhagen, Denmark, has been the largest container ship operator and supply vessel operator in the world. Again, as reported by World Maritime News on 2.28.17, Lázaro Cárdenas welcomed its first vessel, the 9,600 TEU Maersk Salalah.

Maersk Salalah

Mexican President Enrique Peña Nieto and A.P. Moller – Maersk CEO Søren Skou inaugurated the deep-water semi-automated Lázaro Cárdenas Terminal 2 project, representing an overall investment of USD 900 million in Mexico’s expanding economy, welcoming Maersk Salalah.

The second project of Lázaro Cárdenas adds 1.2 million TEU annual throughput capacity to Mexico’s port infrastructure and has an immediate impact on local and international trade growth.

“This is a measure of the attractiveness of Mexico and of our confidence in the future of this country,” Group CEO Søren Skou said in a speech at the inauguration.

“As you can all see, the cranes are poised ready to receive vessels and move the containers that keep the global economy running smoothly. And the port is primed to support all of APM Terminals’ customers.”

With a population of more than 120 million and forecast economic growth of 1.7% in 2017 and 2% in 2018, Mexico is a huge market. It handles Latin America’s third largest container volume after Brazil and Panama.

With the first phase of the terminal complete, APM Terminals Lázaro Cárdenas has a quay of 750 meters in length for ships and a depth of 16.5 meters – deep enough to receive some of the world’s largest container vessels now in service.

Then there is the Panama Canal expansion.

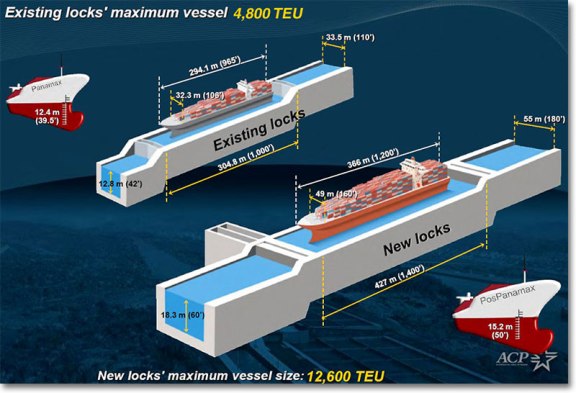

The Panama Canal Expansion Project, also called the Third Set of Locks Project, which the began commercial operation on 6.26.2016 expanded the Canal by doubling its the capacity.

The Project added a new lane of traffic allowing for a larger number of ships, and increased the width and depth of the lanes and locks allowing larger ships to pass.

The new larger size of ships, called New Panamax, are about one and a half times the previous Panamax size and can carry over twice as much cargo.

What is the impact of the Panama Canal expansion?

According to a 6.18.2016 article in The Economist, “It will also change how freight moves around the world. Traffic could divert from the Suez Canal. Larger vessels, which currently ply that route between Asia and America’s east coast, now have the option of going through Panama.

America’s east-coast ports should get busier. In the past, many containers heading from Asia to the eastern seaboard would arrive at west-coast ports, such as Los Angeles and Long Beach, and then travel to their destinations by road or rail.

Bigger ships may now sail directly to ports in the Gulf of Mexico or the east coast, though shipping times will be longer. And vessels carrying liquefied natural gas from America’s shale beds will be able to pass through the locks for the first time, heading to Asia. They are expected to account for 20% of cargo by volume by 2020.

East-coast ports are preparing for the windfall, says Mika Vehvilainen of Cargotec, a maker of cargo-handling equipment. Ports in Baltimore, Charleston, Miami, New York and Savannah are updating facilities to accommodate the Neo-Panamaxes. The Port Authority of New York and New Jersey plans to spend $2.7 billion on enlarging its terminals and shipping lanes, and a further $1.3 billion to raise a bridge by 20 meters.”

On Thursday, 5.11.2017, The Cosco Development sailed up river to the port of Savannah. It is the biggest ship yet to pass through the expanded canal. A Hong Kong ship, it can hold over 13,000 18-foot cargo containers, and according to a 5.13.17 article in The Post and Courier, “it is as long as the Eiffel Tower is tall.”

Photo released provided by the Georgia Ports Authority by Stephen B. Morton/API

The Cosco Development by passed Florida, despite PortMiami being the closest US port to the Panama Canal end even though after its own $2 billion expansion, it can now receive post-Panamax vessels It is expected to be the most desired port for the new ships using the Panama Canal.

Containers arriving in the PortMiami will logically use FECR for railway transportation north.

So with the Panama Canal expansion, with Lázaro Cárdenas being the largest Mexican seaport and one of the largest seaports in the Pacific Ocean basin, and with Grupo México owning Texas Pacifico Transportation Ltd. (TPT), a railroad which operates over the South Orient Rail Line, which runs from the Mexican border town of Presidio, Texas to San Angelo Junction, and with Grupo México having access to FECR tracks, Grupo México has significant inroads into the U.S. railway transportation system.

A possible end-game.

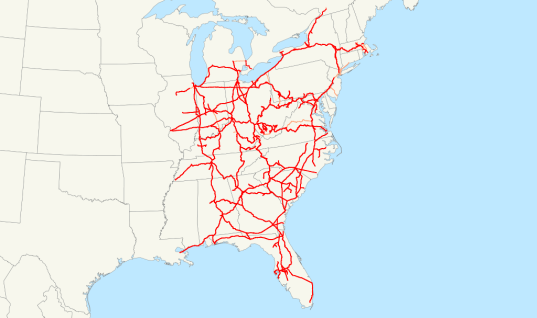

CSX Transportation is a Class I railroad in the United States. The main subsidiary of the CSX Corporation, the railroad is headquartered in Jacksonville, Florida, and owns about 21,000 route miles.

CSX operates one of the three Class I railroads serving most of the East Coast, the other two being the Norfolk Southern Railway (NS) and Canadian Pacific Railway. Also serving the Canadian provinces of Ontario and Quebec, together CSX and Norfolk Southern Railway have a duopoly over all east-west freight rail traffic east of the Mississippi River.

Wikipedia

If Grupo México can bring CSX into the fold as a partner, they would have direct access to roughly 90% of the U.S. population. Group México and CSX have the best rail footprint for servicing the largest concentration of financially capable consumers in the world.

Grupo México’s acquisition of FECR is moving so fast this may be the plan of the parties involved to move it through before the opposition can get wind of their progress.

Pingback: Who Owns Grupo México, S.A. de C.V., Who Acquired Florida East Coast Railway? | Vero Communiqué